Ethereum recently upgraded the protocol to with EIP-1559. Without going into the weeds, it means transactions no longer use an auction system where anyone submitting a transaction was competing with everyone else by submitting higher gas prices, which miners would prioritize and confirm in a block. Now, Ethereum uses a hybrid system involving base fees and tips called EIP-1559.

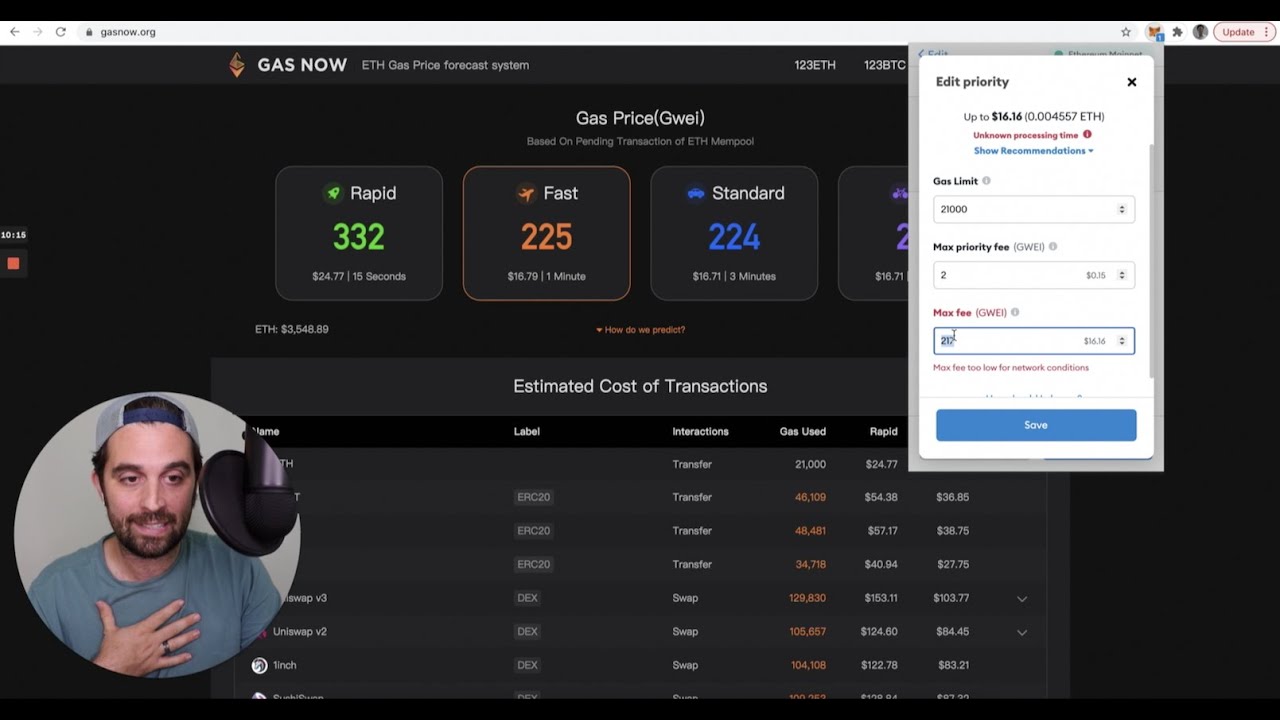

This tutorial should hep anyone better understand how to set fees as low as possible (Max priority fee and Max fee) on MetaMask transactions, and consistently and predictably confirm transactions.

TDLR: Save money on gas but not worry about stuck transactions.

1️⃣ Background on EIP-1559

2️⃣ How to manually set Max priority fee + Max fee

3️⃣ Examples of transactions where I set the fees at lower prices

In a part of the video, I assume Base fee (set by Ethereum network) + Max priority fee (tip for miners) = Max fee, which is not exactly how EIP-1559 fees work. However, the way I explain it is easier to understand and it holds up in practice for setting fees on MetaMask. I’ve linked some great guides below on EIP-1559 for anyone wanting to understand more of the specifics behind EIP–1559 transaction fees.

Helpful Resources:

🛠️ Here’s the EIP-1559 guide I read from the Cryptopedia article by Gemini: https://www.gemini.com/cryptopedia/ethereum-improvement-proposal-ETH-gas-fee

🛠️ Here’s the link I used for tracking live gas prices: https://gasnow.org/

🛠️ Here’s another gas estimator designed specifically for EIP-1559 by Blocknative: https://www.blocknative.com/gas-estimator

🛠️ I would highly recommend this EIP-1559 guide by Blocknative: https://www.blocknative.com/blog/eip-1559-fees

🛠️ Here’s another great guide on EIP-1559 by Anthony Sassano at The Daily Gwei and our good friend Nader: https://thedailygwei.substack.com/p/this-is-eip-1559-the-daily-gwei-300

📺 Subscribe to DeFi Tutorials with DeFi Dad on Youtube

🐤 Follow me @DeFi_Dad on Twitter

😎 Building a DeFi/NFT project? Contact our investment team at contact@fourthrevolution.capital.

—-

Disclaimer & Risks: No one paid me to produce this video. This is not financial advice and you should approach all DeFi applications, wallets, protocols, and tools with caution. Please be aware there is always risk in using DeFi, including technical risks (ie smart contracts hacks), financial risks (ie liquidity crises), and potentially admin risk (admin key compromise, governance vulnerabilities). There’s risk of any pegged asset failing.

Comments